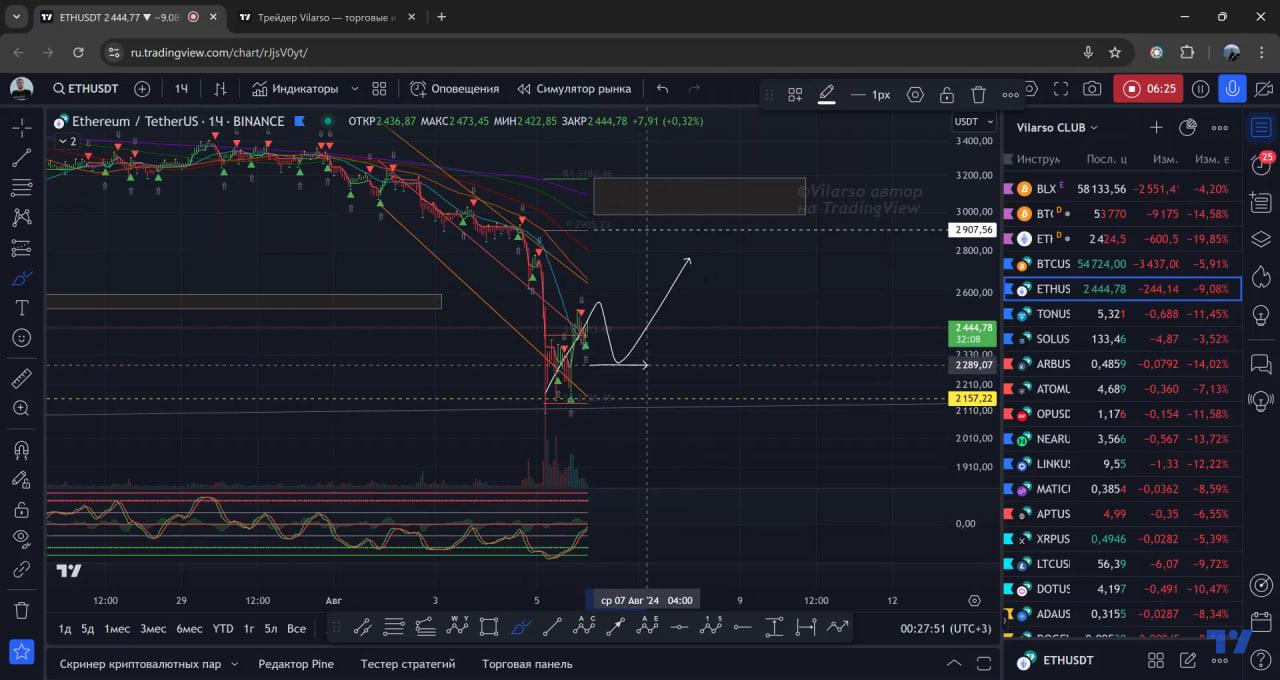

There was a lot of buzz and talk about an Ethereum ETF, and the price went up. Then it went into a prolonged sideways trend since March. But as soon as the news broke that the #Ethereum #ETF was approved, the price started to drop!

So, this just proves once again that the saying "buy the rumor sell the news " still holds true!

Keep that in mind...

What Does "Buy the Rumor, Sell the Fact" Mean?

Imagine you own shares of Company X. Now, suppose there are rumors that, if proven true, could drive up the stock price of Company X. Hearing this rumor, you decide to invest more in the company (buy the rumor). As soon as the rumor is confirmed and the stock price surges, that's when you sell your shares (sell the fact) to make a profit.

Buying the Rumor, Selling the Fact in the Crypto World

It's no surprise that this strategy is widely used in the crypto world, where rumors are abundant. However, it's challenging to find concrete evidence of this strategy in action, as much of the information remains speculative and the true intentions of many investors are unknown. What you can observe are coins that receive a lot of attention, perform well, and then suddenly their performance fades. One example might be Dogecoin.

Dogecoin's Rumor and Sales Story

DOGE saw most of its action between April and June 2021, mainly due to a tweet from Elon Musk about the coin. The price soared from nothing to just under $0.75. But from late May, the price began to gradually decline and might soon drop below $0.15. What's notable about these price movements is that they were triggered by Elon Musk's tweets about the coin. He hinted that Tesla might accept DOGE as payment. During this period, the price surged suddenly, marking the initial phase when Musk was tweeting about it. However, after Tesla didn't commit to making it a viable payment option, the price dropped.

The Significance of "Buy the Rumor, Sell the Fact"

The key point of the "buy the rumor, sell the fact" trading strategy is that it highlights an important issue: many investors aren't interested in developing their own strategy. Essentially, this strategy answers the question, "How can I best invest my money?" The problem is that when investors ask this question, they often ignore the chance to truly study and experiment with strategies on their own to find what works for them. Instead, they turn to others (like online sources) hoping for a quick and easy answer. What happens is that rather than deepening their understanding of the market, they end up with a fabricated view that often leads them astray. Do you really think Warren Buffett listens to others' investment advice? Or do you think he experiments and develops his own investment strategies?

Conclusion

Relying on the "buy the rumor, sell the fact" principle as an investment strategy is risky business. It’s filled with uncertainty. The amount of research needed to stay informed and accurately predict upcoming events is immense. Therefore, for beginners, this might not be the best starting point.