Fellow Community Members,

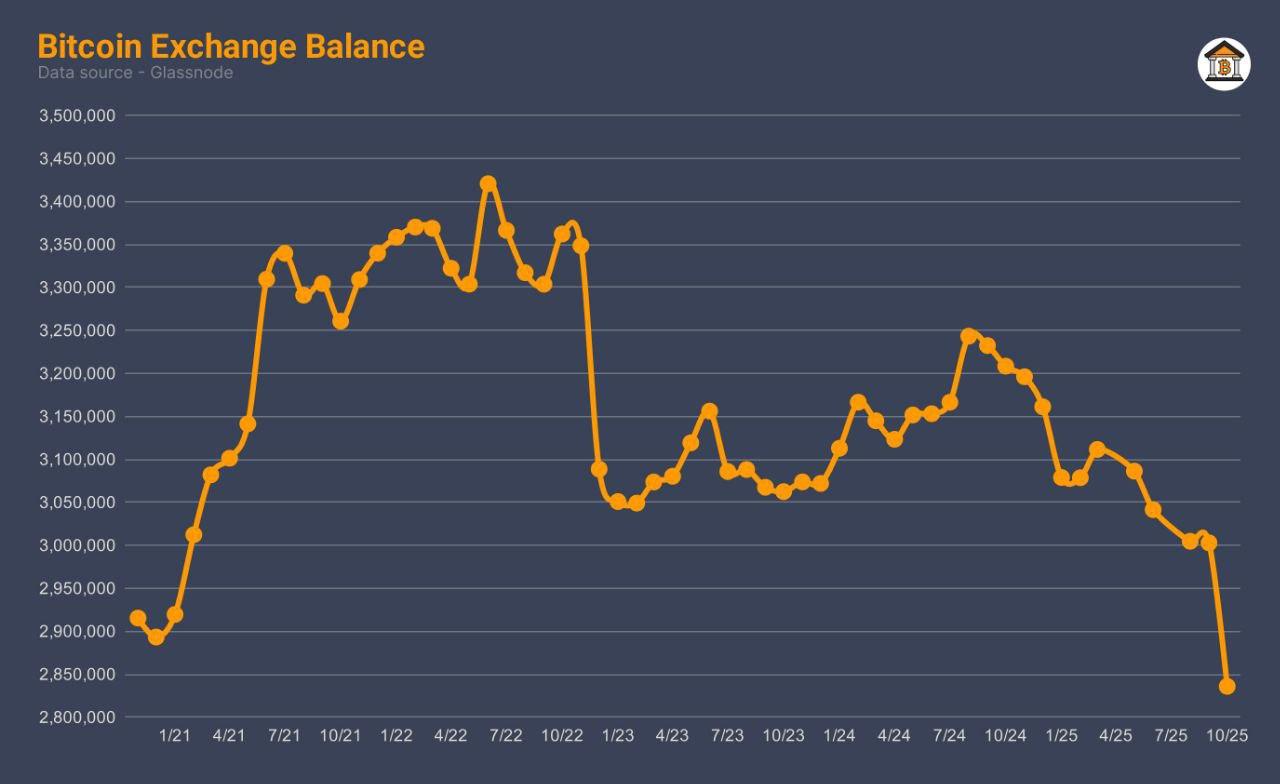

Over the past month, on-chain analytics have shown a significant trend that demands our attention: approximately 170,000 BTC have been withdrawn from crypto exchanges. Consequently, the total exchange balances for Bitcoin have dropped to a 5-year low.

As CEO, my goal is to provide you with an expert assessment of this movement, ensuring you have the clarity needed to navigate the market.

What This Data Signifies

A sustained, large-scale withdrawal of Bitcoin from trading platforms is generally viewed by long-term analysts as a strong bullish indicator. This trend, based on our decade of experience operating in this space, points to several key investor behaviors:

- Shift to Long-Term HODLing: Large holders, often referred to as whales, are moving their coins from easily accessible exchange wallets to secure hardware (cold storage) wallets. This signals a conviction in Bitcoin's future price and a lack of immediate intent to sell.

- Contraction of Sell-Side Liquidity: Fewer Bitcoins on exchanges means a reduced supply available for sale. If demand spikes, this tight supply can lead to more volatile, but potentially sharper, upward price movements.

- Increased Security Focus: This is a healthy move that reflects market maturity. Following past industry events, investors are prioritizing the core crypto principle: "Not your keys, not your coins." They are taking self-custody seriously, which ultimately strengthens the network's decentralization.

This is a fundamental repositioning of assets, favoring long-term conviction over short-term trading.

Our Unwavering Commitment

While we can't control user decisions regarding self-custody, we are acutely focused on our responsibility: the safety and security of the funds that remain on our platform.

To maintain your trust, we reaffirm our commitment:

- Full Reserve Coverage: Our exchange maintains 100% of the reserves needed to cover all user assets. We continue to conduct regular Proof-of-Reserves audits for full transparency.

- Best-in-Class Security: Our cold/hot storage architecture, multi-sig processes, and robust multi-factor authentication systems meet the highest industry standards to safeguard your assets from external threats.

- Operational Reliability: We continue to invest in our infrastructure to ensure deep liquidity and flawless execution for those who actively trade.

The market is maturing, and investor decisions—whether to trade or to HODL in cold storage—reflect a growing sophistication. We respect both choices and stand ready to serve your needs for trading, staking, and accessible liquidity.

Thank you for your continued confidence in our platform.